What is the TD1?

The Tax Declaration Form 1 (TD1) is used to determine the correct tax liability of an individual/employee. It must be completed and lodged with your employer, on commencement of employment and annually thereafter or where there is a change in income or tax credits.

Why do you file the TD1?

As an employee earning emolument income, there are several expenses which the Government of Trinidad & Tobago will approve as a deductible before the calculation of your income tax. Utilize this form to manage PAYE deductions from your salary.

Do you qualify to file the TD1?

You can file a TD1 form if you have one or more of the items below. These items form part of approved deductible before the calculation of your income tax. These allowable expenses are:

- Tertiary Education Expenses, (Institution situated outside of Trinidad & Tobago)

- First Time Home Owner Deduction

- Approved Deferred Annuity Contributions

- Alimony/Maintenance Payments

- Tax Credits: (Venture Capital, CNG & Cylinder, Solar Water Heating Equipment, National Tax Free Savings Bond.), National Tax Free Savings Bond.)

Do any of the five areas applies to you? If yes, then you should be looking to file your TD1 form.

How to file your TD1 Form.

Step #1: Have all your documents present

Be sure to have the following documents available when you are going to file:

- Employee B.I.R. File Number

- I.D. Card Number

- Information on your Income from Salary, Wages or Pension: (including taxable allowances and benefits in kind) from one or more employers.

- Include the Name and Address of Employer/s

- PAYE No of Employer (its ok if you don’t have it, but this can be found on your TD4. Include rate of pay and annual Salary

Step #2: Get a Copy of the TD1 Form

The TD1 form is available at http://www.ird.gov.tt/Media/Default/IRDForms/F-TD1–.pdf and can be downloaded and printed. Also ask your company’s accountant, they might be able to assist with sourcing a form.

Step #3: Fill out the TD1 Form

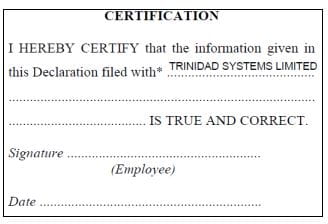

Using block letters fill in the required information on the TD 1 form. Before you start filling out your TD1, have all information on hand. Insert the company name, the declaration is filed with. Remember to sign

Step #4: For each claim, be sure to have your supporting documentation

Tertiary Education Expenses - This is for expenses paid in the current income year. For Institution situated outside of Trinidad and Tobago (except a Public Regional Institution) will be allowed. Expenses are limited to $60,000 per household.

Supporting Documentation:

- A detailed statement of expenses incurred together with a letter of acceptance from institution.

- Evidence of remittance of funds (receipts, bank drafts or encashed cheques).

First Time Acquisition of House - This is for persons who acquired a house by way of purchase or construction for use as your residence on or after January 1st 2011. Claim is limited to $25,000 and will be granted for 5 years from the date of acquisition.

Supporting Documentation:

- Statement from the Financial Institution/Affidavit confirming first time acquisition, date and cost of acquisition.

- Completion Certificate if property was constructed.

- Land and Buildings Taxes receipts. (Copy of Certificate of Assessment. If applicable).

Contributions/Premiums - You may claim Contributions to Government Widows’ and Orphans’ Pension Fund, approved Provident and Superannuation Funds, approved Funds or scheme, approved Pension Fund Plan and premiums paid under an Approved Deferred Annuity plan including deduction in respect of Approved Tax Incentives savings plan operated by Financial Institutions to a maximum of $50,000.00.

Supporting Documentation:

- A statement of contributions paid in the previous year.

Alimony/Maintenance - A copy of the Registered Deed/Court Order and evidence of payment in the previous year.

Tax Credits

Venture Capital Tax Credit - The credit is allowed in the year of income to the original purchaser of shares in the Venture Capital Company.

CNG Kit and Cylinder Tax Credit - Tax Credit is allowed in the year of purchase. The credit is 25% of the cost up to a maximum of $10,000.

Solar Water Heating Equipment Tax Credit - Tax Credit is allowed for Solar Water Heating Equipment purchase in the year of income for household use. The credit is 25% of the cost up to a maximum of $10,000.

National Tax Free Savings Bond Tax Credit - The credit is allowed in the year of income to the original purchaser of bonds issued under the National Tax Free Savings Bonds Regulations. The credit is 25% of face value limited to $5,000 where the maturity period is five, seven or ten years. Unclaimed credit in an income year can be used to offset tax assessed in succeeding year.

When submitting your TD1 for approval, please remember to sign and provide a copy of your payslip together with documents in support of the claims made as outlined on the form.

Step #5: Visit your local BIR Office

After completing the form, and collating your supporting documents, visit your local BIR office to file the TD1 form. Depending on the office location the filing process can take between 30mins-2hrs. Approval is granted at the same time.

Step #5:

Take back to employer and they will put it in and then it reduces your PAYE next cycle.